NuOrbit: One Settlement Rail For All Your Stablecoin Flows.

Every new chain, stablecoin, and venue adds more friction to moving money. NuOrbit turns fragmented, chain-specific stablecoin payments into a single programmable settlement rail: integrate once, and you can accept stablecoins from many chains and trusted assets through one service layer instead of one integration per network.

Under the hood, NuOrbit observes stablecoin payments, turns them into settlement-grade proofs, and either uses its own liquidity to fund your apps where their logic or liquidity lives (Cross-chain funding and execution), or simply delivers verifiable “this payment happened” receipts for your own addresses (Multi-chain payment proofs). You keep your custody, execution logic, and risk engine; we remove the cross-chain payment plumbing.

Why NuOrbit Exists

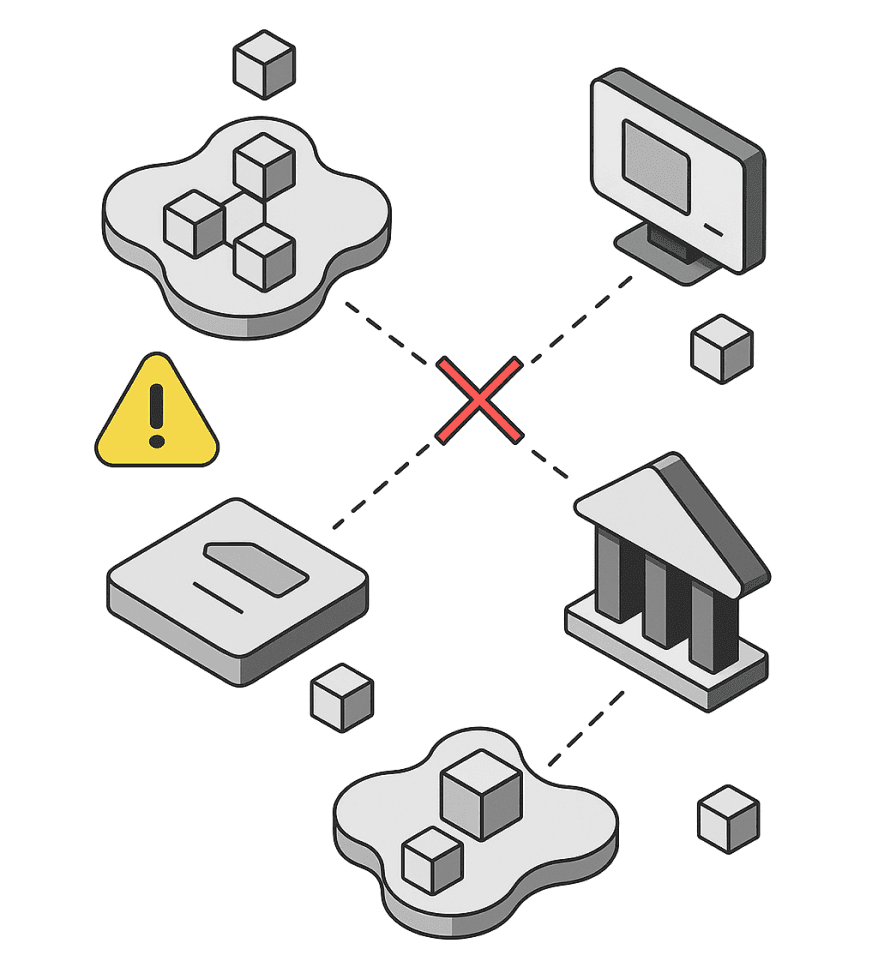

Stablecoin value is stuck in silos.

• Each chain needs its own integration and monitoring.

• Each payment network only supports a limited list of assets.

• Each institution runs its own reconciliation and risk logic.

The result:

• Users hit “wrong network” and abandon payments.

• Teams glue together bridges and ad-hoc APIs to patch gaps.

• Money appears to move faster in dashboards than it does in your actual settlement systems.

NuOrbit lets you treat all of this as one clearing network for stablecoin transactions. Instead of wiring directly into every chain and rail, you connect once to a shared settlement rail and use it to move value or confirm payments wherever you need them.

What NuOrbit Is

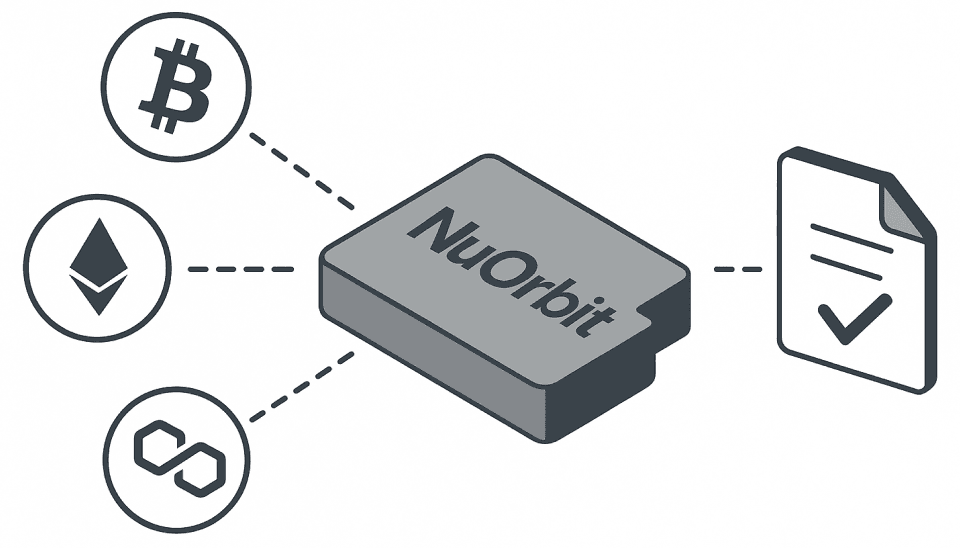

NuOrbit is a proof-driven settlement rail for stablecoin transactions across chains

When a supported payment finalises on a ledger, NuOrbit normalises it into a standardised, signed proof of what happened. Partners then use that proof in different ways: some ask NuOrbit to use its own liquidity pools to fund their apps on the chains where their logic or markets live (Cross-chain funding and execution); others simply consume the proof as a clean “this payment is done” signal for addresses they control (Multi-chain payment proofs). In both cases, user and client assets stay on the chains and with the custodians they already trust, and no one has to push end-users through public bridges or wrapped tokens.

You consume NuOrbit as an SDK and API, not as a low-level protocol. Under the hood we build on existing chains, stablecoins, and standards like x402 — we are not a new chain, a bridge, a wallet, or a stablecoin issuer, but a service layer that can support new settlement patterns as partners’ stablecoin use cases evolve.

What You Get With NuOrbit

One rail for many chains

Handle stablecoin flows across multiple networks through a single settlement layer instead of wiring each chain separately. New chains and assets plug into the same rail instead of spawning a new project.

Native assets, no extra wrappers

User and client assets remain on the chains and with the custodians that already hold them. When cross-chain funding is needed, NuOrbit uses its own pools rather than pushing users into lock-and-mint bridges or new wrapped tokens. What moves between systems are verified facts about payments and funding events.

Settlement-grade visibility

Every relevant payment becomes a structured proof you can route into risk, compliance, treasury, and accounting systems, giving you one canonical settlement trail instead of per-chain spreadsheets.

Less operational drag

Reduce custom bridges, polling scripts, manual checks, and out-of-band confirmations. One proof format replaces many bespoke workflows across teams.

Room to grow

Add new chains, stablecoin issuers, and products onto the same rail, so growth in coverage doesn’t translate into linear growth in complexity.

A fused dollar rail across trusted stablecoins

Optionally treat several trusted, whitelisted stablecoins as one USD-denominated rail at the settlement layer. Users can pay with many stablecoins while your treasury and reporting focus on the few assets you actually want to hold.

Built On NuOrbit

NuOrbit’s rail appears in two primary modes today, with room to support more patterns as partners expand how they use stablecoins at scale.

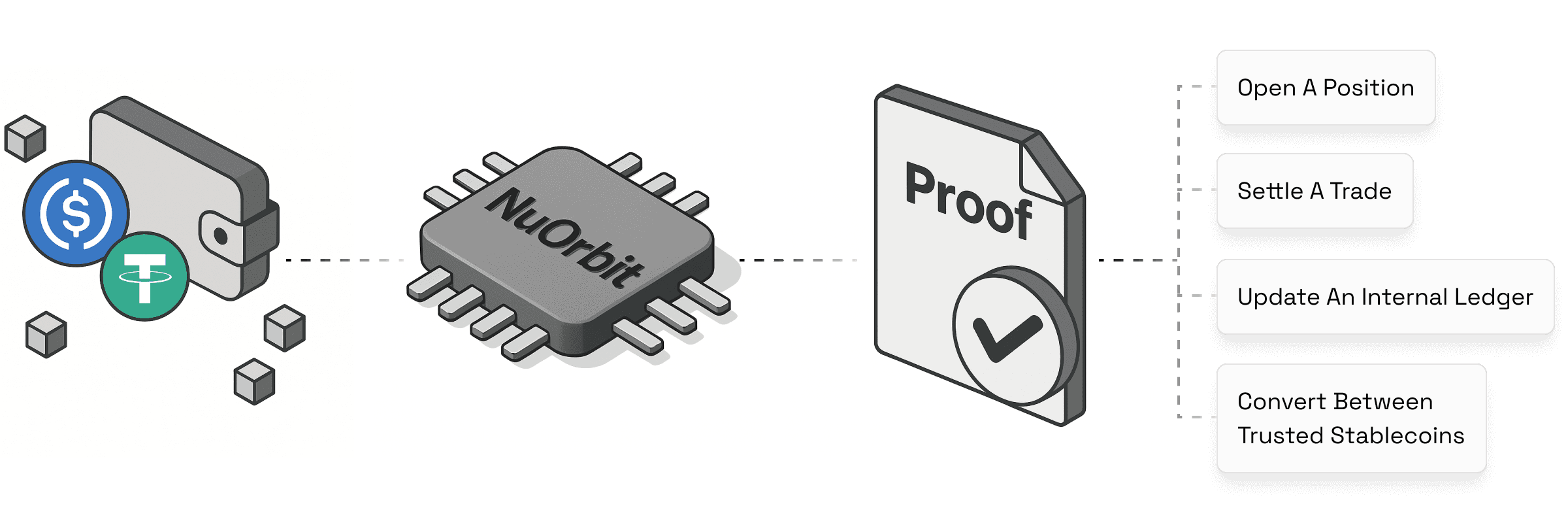

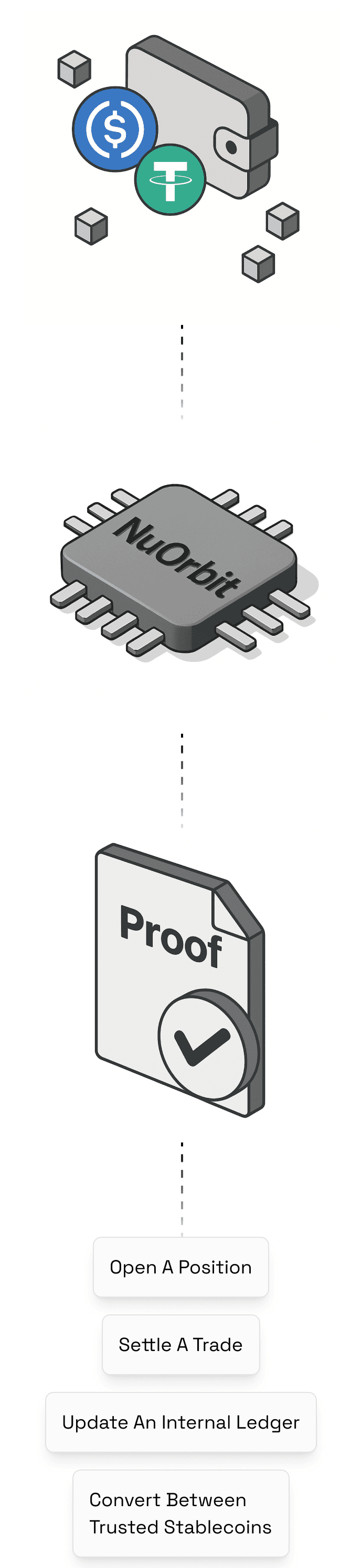

Cross-chain Funding And Execution

In Mode 1, users pay stablecoins on a source chain they already use, and your app receives funds on the chain where its contracts or liquidity live. NuOrbit proves the source-chain payment and uses its own liquidity pools to fund your destination addresses on the target chain, so your contracts and risk engine see a normal deposit even though the funding came from another chain. No user-facing bridge, no wrapped token; the bridge-like complexity stays internal to NuOrbit.

Use this for:

• Payments & stablecoin networks that want to accept many stablecoins and chains, then treat a chosen set of them as 1:1 inside their own rail – including branded dollars – without wiring into every chain separately.

• Chains & ecosystems that want their native stablecoin to be the funding currency for lending, perps, and other activity on external ecosystems, while TVL and fees stay booked on their own ledger.

• Institutions, custodians, and exchanges that want deposits or balances held in one place to power positions and activity in another venue, without using bridges or wrapped assets.Institutions, custodians, and exchanges that want deposits or balances held in one place to power positions and activity in another venue, without using bridges or wrapped assets.

You keep control of your execution logic, risk engine, and which assets you treat as interchangeable.

NuOrbit gives you the verifiable link between “this payment happened here” and “this action was taken there.”

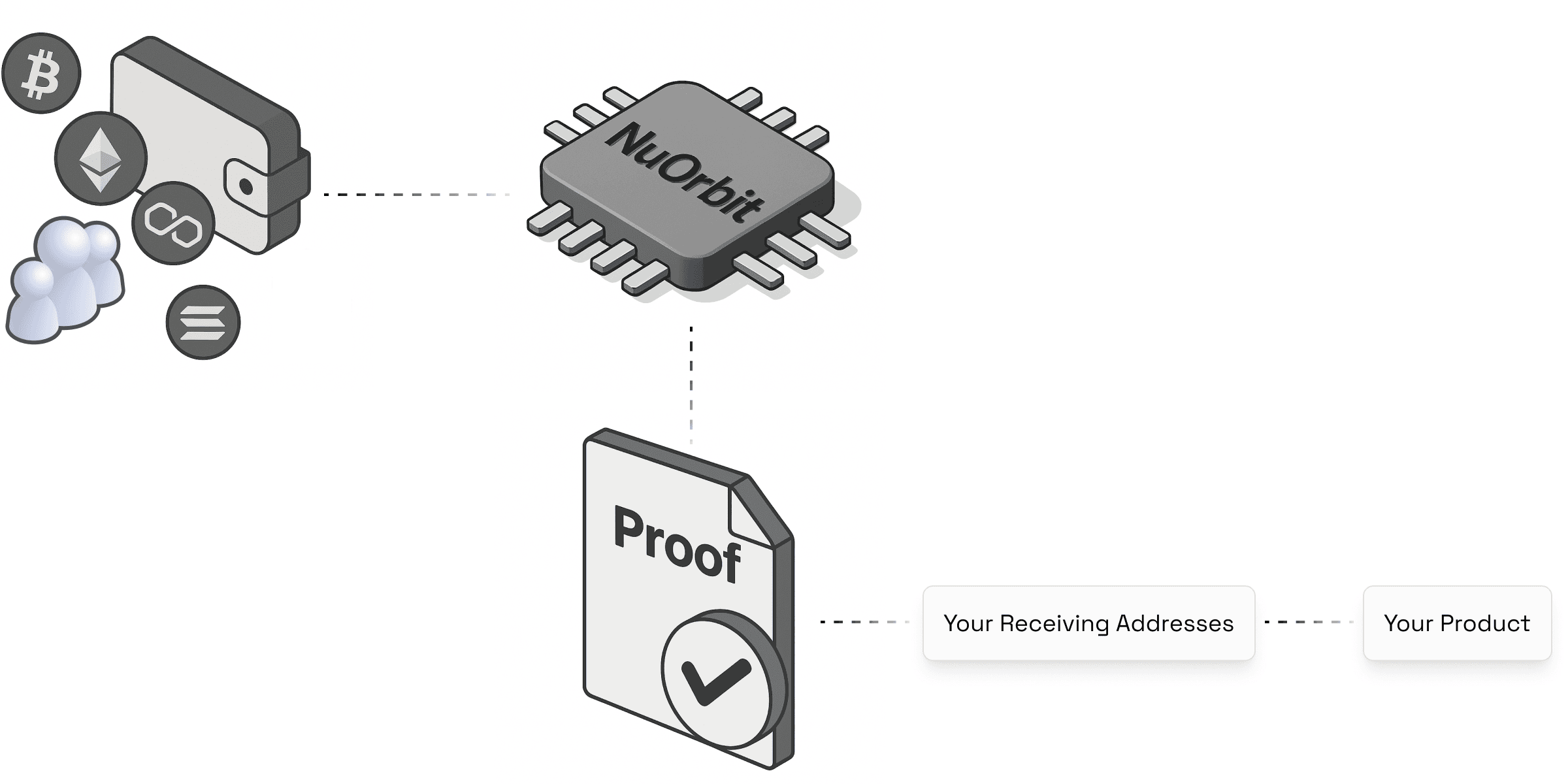

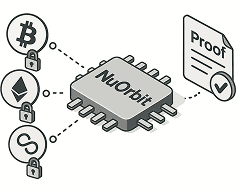

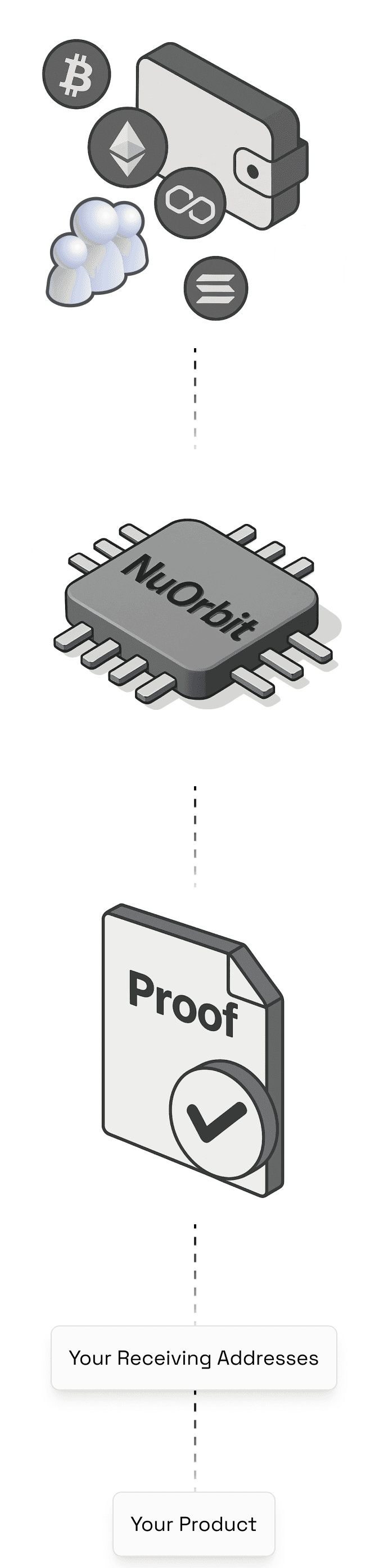

Payment Proofs

You keep full control of your own receiving addresses on each chain. Users send stablecoins directly to those addresses as normal token transfers. NuOrbit watches those addresses, waits for your chosen level of finality, and generates a standardised payment proof — who paid, how much, in which asset, on which chain, to which address, at what time. Your systems verify the proof and use it as a clean, verifiable “paid” signal to unlock content, flag invoices, or update internal ledgers. NuOrbit never takes custody.

Payment proofs is for any case where you need a clean, cross-chain “has this been paid?” answer without changing how or where you hold the money.

How NuOrbit Fits Into Your Stack

NuOrbit is an SDK and proof API that plugs into the systems you already run.

You:

NuOrbit works alongside:

You keep your architecture.

NuOrbit gives it a shared settlement layer.

Ready For Real Flows

NuOrbit is ready for teams that already move stablecoins across chains or rails and want a cleaner way to do it. The settlement rail, proof format, and SDK are stable enough for pilots and early production. Each new integration extends the same rail instead of creating another one-off connection, so your investment compounds rather than fragmenting over time.

Use Case