Connect To Digital Asset Flows Without Breaking Custody.

Clients expect access to stablecoins and tokenised markets. Regulators demand control, audit trails, and clear asset location. NuOrbit lets you plug into on-chain flows while keeping assets under existing custody and supervision, so both sides get what they need.

The Bind You Are In

The universe of stablecoins and tokenised liabilities keeps expanding, multiplying the number of issuers, instruments, and risk profiles you’re expected to understand and monitor. At the same time, you can’t hand assets to unregulated bridges, allow multiple unsynchronised ledgers to exist, or let counterparties define settlement on their own terms.

Most current solutions ask you to bend custody to fit crypto; you need crypto settlement that fits custody.

What NuOrbit Provides

NuOrbit introduces a standard way to prove settlement events across chains and systems. When a relevant payment, transfer, or allocation finalises on a ledger you trust, NuOrbit produces a signed settlement proof for that event. Internal systems, counterparties, and external venues can all verify the proof independently. Everyone sees the same description of what settled without gaining direct control of the underlying assets.

In simple terms:

SWIFT defined a common language for interbank fiat settlement. NuOrbit is defining a common language for stablecoin settlement across chains.

What You Get

Clear asset location

Assets stay in your accounts and custodied structures. What moves between systems are settlement proofs tied back to those holdings.

Audit-ready records

Each significant movement leaves behind a structured, signed record that can be stored, anchored, and matched to your internal books. Examiners see evidence, not screenshots.

Operational leverage

Settlement cycles compress from days to seconds without asking you to trust opaque bridges or new custodians. Costs and manual reconciliation work drop in parallel.

Concrete Plays

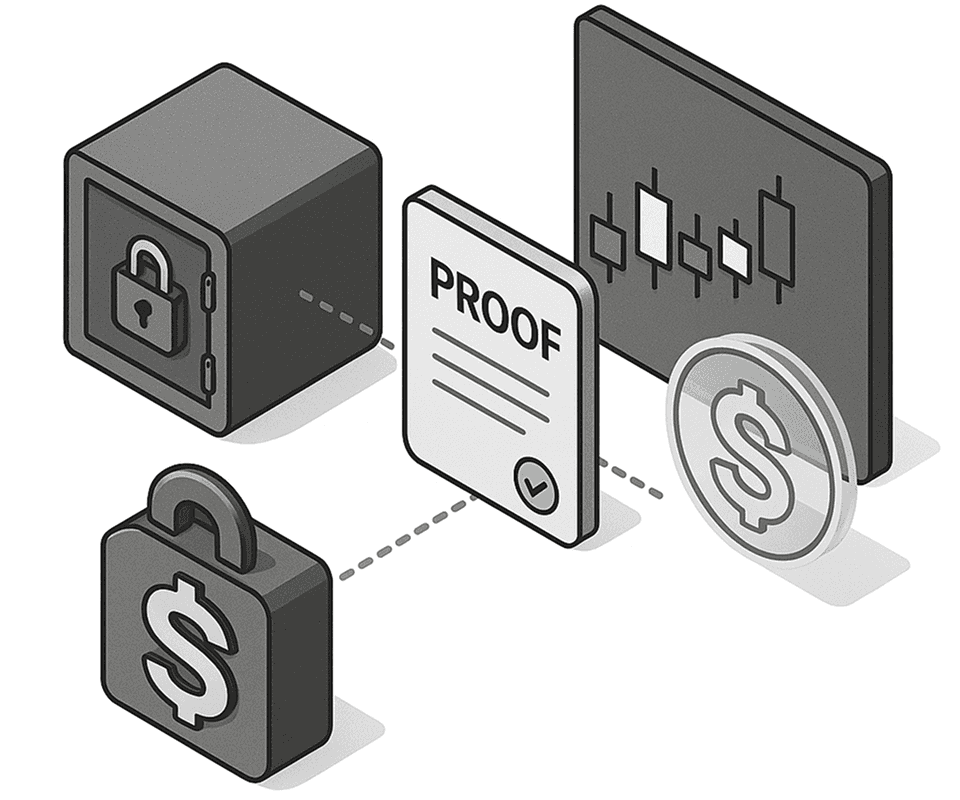

Asset under custody, position in external markets

A client designates part of a stablecoin balance in custody as funding.

NuOrbit proves that funding action.

An external venue uses that proof to open or adjust a position.

Your books still show the asset at rest.

The proof links that asset to external exposure in a way auditors and risk teams can trace.

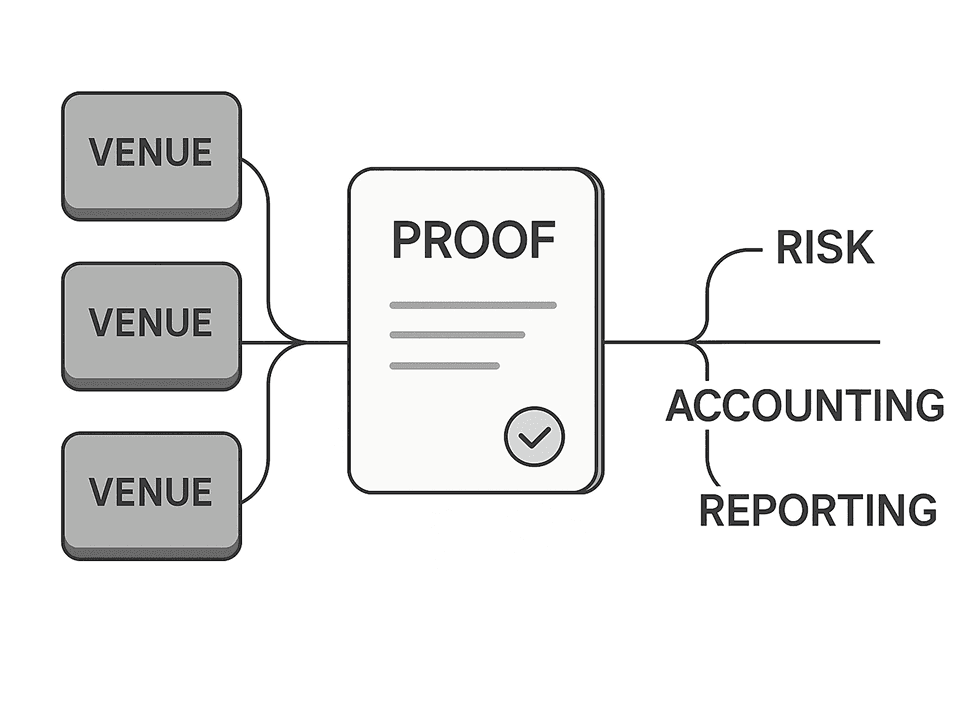

One settlement trail across many venues

Each venue today tends to deliver its own view of settlement.

With NuOrbit you can ask that key flows also emit NuOrbit proofs.

Those proofs feed into risk, accounting, and reporting as a single canonical trail.

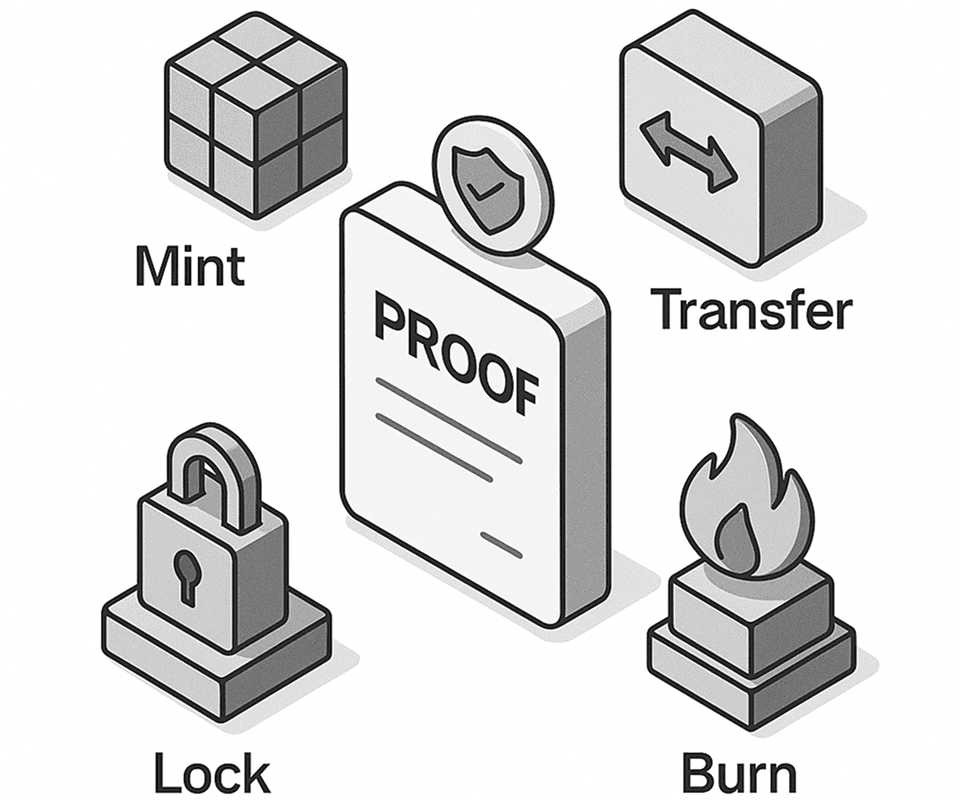

Institutional stablecoins and tokenised products

If you issue a regulated stablecoin or tokenised deposit, NuOrbit can underpin mint, burn, transfer, and lock events with settlement proofs.

Clients get instruments that behave like serious products.

Supervisors get a control framework that makes sense in their language.

Why Move Now

Tokenised markets are growing more real every quarter. At the same time regulators are turning away from complex bridge stacks and synthetic assets that are hard to supervise.

As supervisors start asking for provable settlement flows instead of screenshots and ad-hoc reports, the firms that can show a clear proof-based framework will define what “good” looks like for everyone else. Those early adopters won’t just be compliant; they will become the preferred rails for high-quality, regulated flow.

NuOrbit is the layer that lets you get there without tearing up your custody model. It lets you say yes to digital asset flows while still being able to show exactly where assets are and what has settled.

Use Case