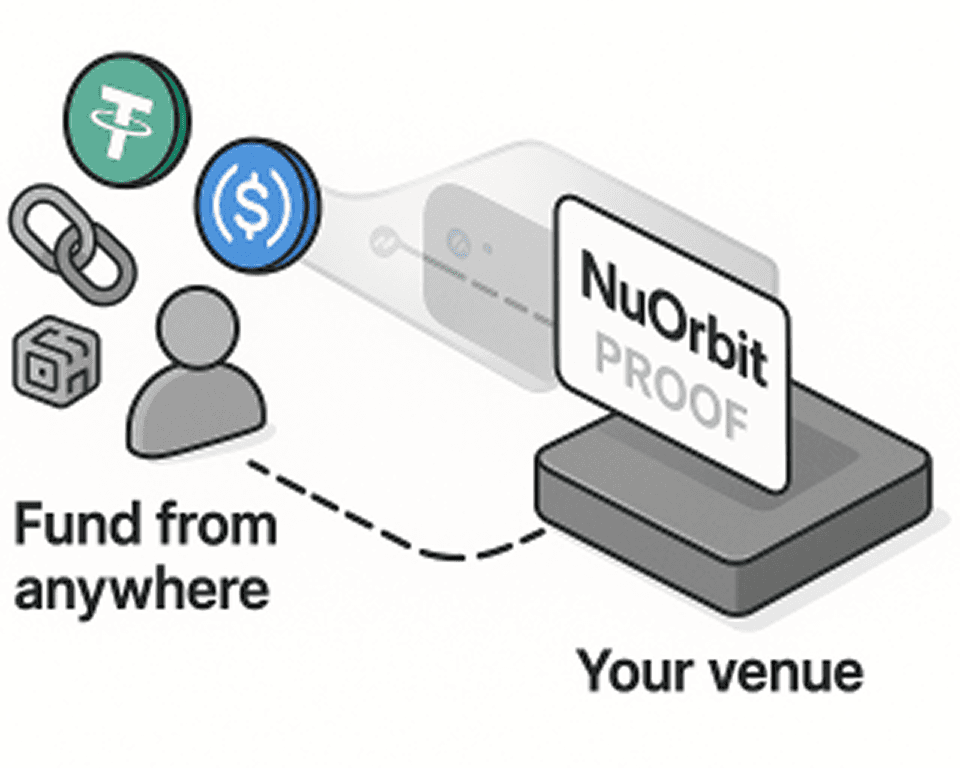

Accept Funding From Many Chains Without Importing Their Chaos.

Traders want to fund from wherever they already hold stablecoins. You want that volume and collateral, not every bridge risk and operational edge case that comes with it. NuOrbit lets you treat stablecoin deposits from many chains as one clean settlement primitive.

The Multi-Chain Reality For Venues

Offering deposits and withdrawals on more networks sounds like growth. In practice it often means more wrapped versions of the same asset to track, more one-off integrations to build and maintain, more ways deposits and claims can drift out of sync, and tougher conversations with compliance and regulators.

What NuOrbit Changes

NuOrbit turns stablecoin funding events on users’ home chains into settlement proofs your venue can rely on. A user funds or locks stablecoins on a supported chain. NuOrbit watches that chain and generates a proof when the event is final. Your venue consumes the proof and credits the user inside your own ledger or risk engine. You still decide what assets you accept, how you manage exposure, and how you handle withdrawals and netting — NuOrbit simply gives you a safe and consistent way to acknowledge that the money is real.

What You Get

Multi-chain deposits with one internal model

You can let users fund from several supported chains and assets while treating everything as one type of verified deposit in your systems

Cleaner asset inventory

You do not need to hold and manage every wrapped token that appears. You can focus your treasury on a smaller set of base assets while still accepting more kinds of inflows.

Better stories for risk and compliance

Every credited deposit and every funding movement has a proof attached. You can show how collateral and balances are backed without exposing internal ledgers.NuOrbit lets you expand your funding surface without turning every new network into core technical and regulatory risk inside your venue.

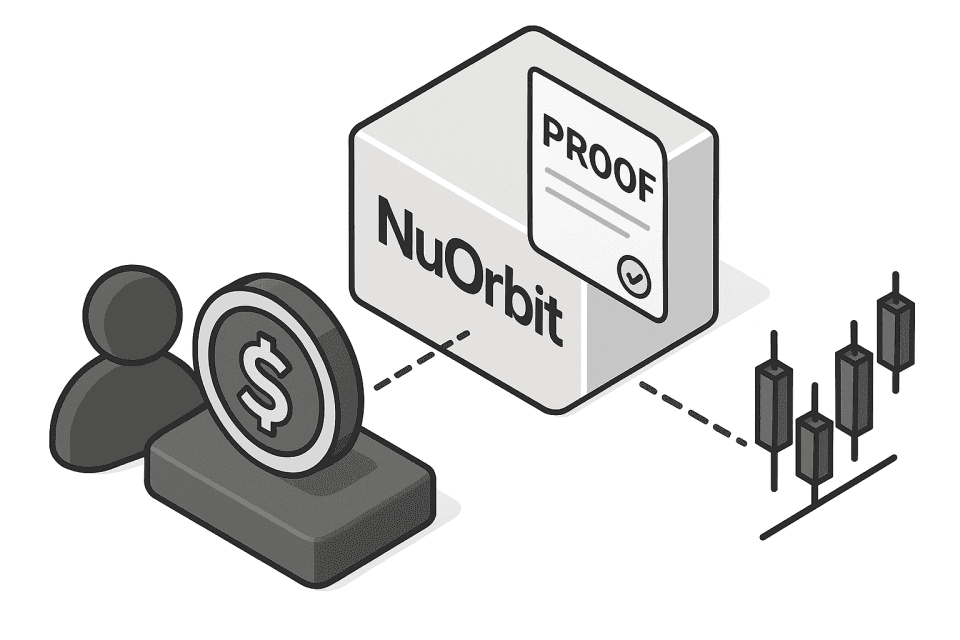

Concrete Plays

Fund From Anywhere While Your Core Stays Simple

Users top up from a variety of chains and stablecoins.

NuOrbit proofs attest to those inflows.

Your venue records a single consistent balance per user driven by those proofs.

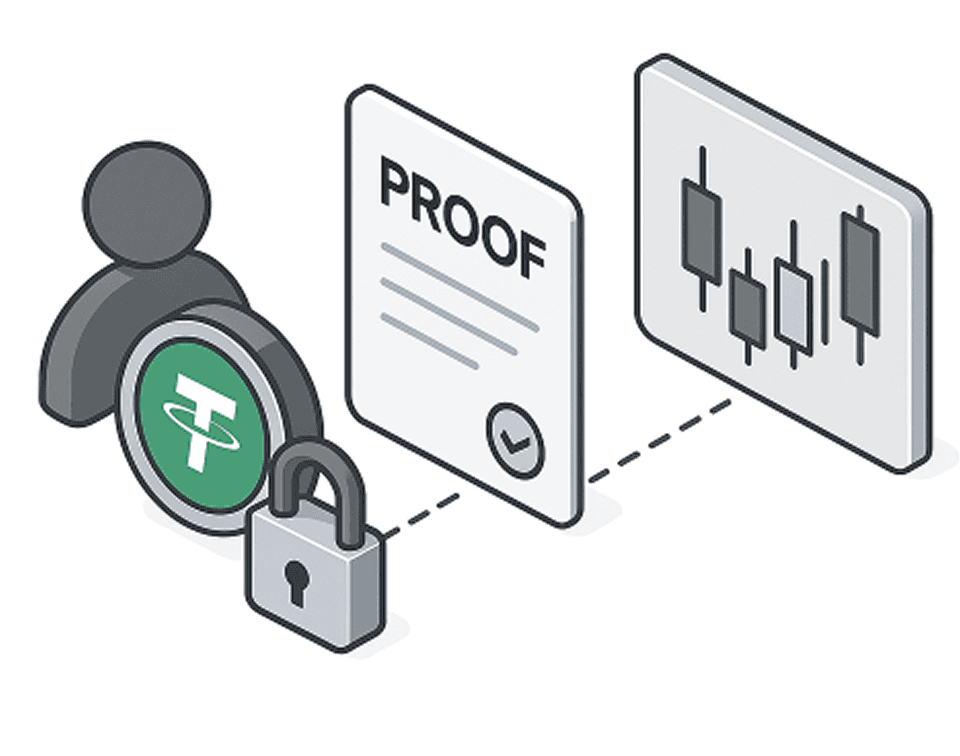

Offer Cross-network Collateral Without Bridges

Users keep assets where they are comfortable.

You allow them to post that value as collateral by accepting NuOrbit proofs of locked funds.

You structure your own hedging and exposure without relying on risky bridge infrastructure.

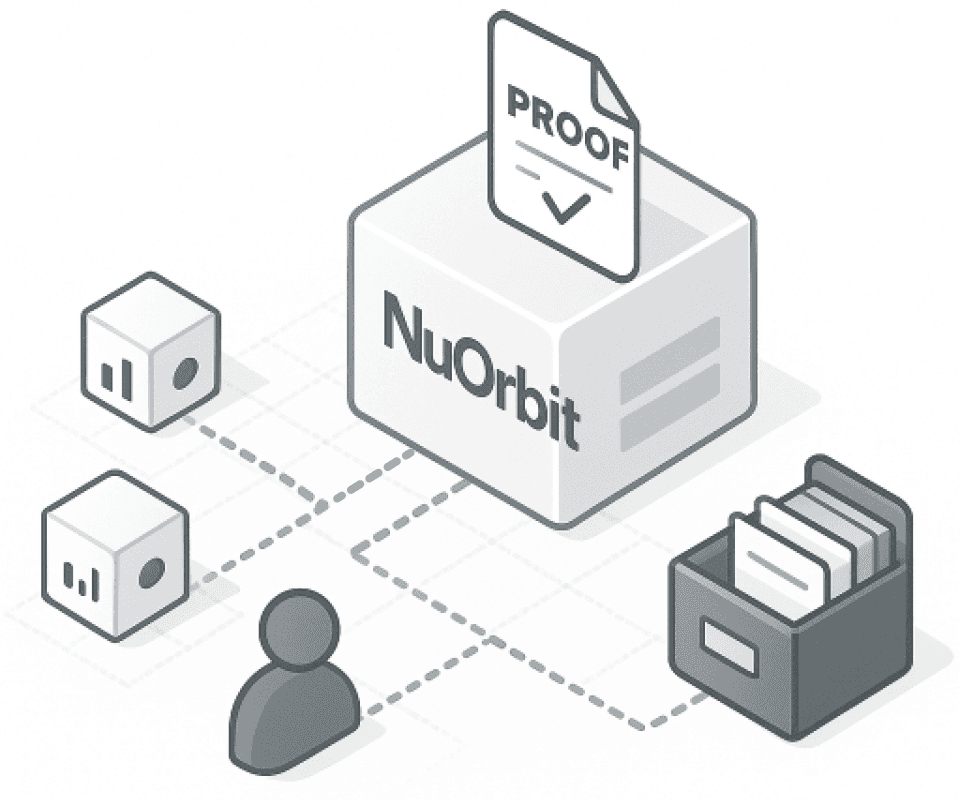

Participate In shared Liquidity And Settlement Fabrics

If you operate or connect to multiple venues, you can use NuOrbit proofs as the common reference for who has what funding where.

Treasury and risk teams see one settlement trail even as order flow and execution span several environments.

Why Move Now

Traders are already wary of fragile bridging paths.Institutions are already asking exactly where collateral lives.

As more serious traders and regulated funds avoid venues that depend on opaque bridge flows, “multi-chain” without a proof-backed story will stop being an advantage and start being a red flag. Venues that can accept funding from many chains and still show a clean, proof-backed story of balances will be the natural home for that flow.

NuOrbit lets you be that venue without tearing apart the engine and risk systems that already work.

Use Case