Global Reach. Zero Custody Risk.

The "Black Box" Era is over. Access DeFi yields and cross-chain liquidity without ever moving your assets into a risky bridge contract. NuOrbit acts as your Regulatory Safe Harbor, verifying settlement while your assets stay safe in cold storage.

The Compliance Straitjacket.

You are stuck between a rock and a hard place.

• The Opportunity: Tokenized markets and stablecoins are exploding.

• The Risk: Regulators won't let you touch "unregulated bridges" or "synthetic assets."

• The Result: You watch from the sidelines while the market moves on without you. Current solutions ask you to "bend the rules." We don't.

Verification-as-a-Service.

NuOrbit introduces the "Swift Standard" for stablecoins. We don't touch your money. We verify the truth.

• Step 1: You execute a transfer within your existing qualified custody (e.g., Fireblocks).

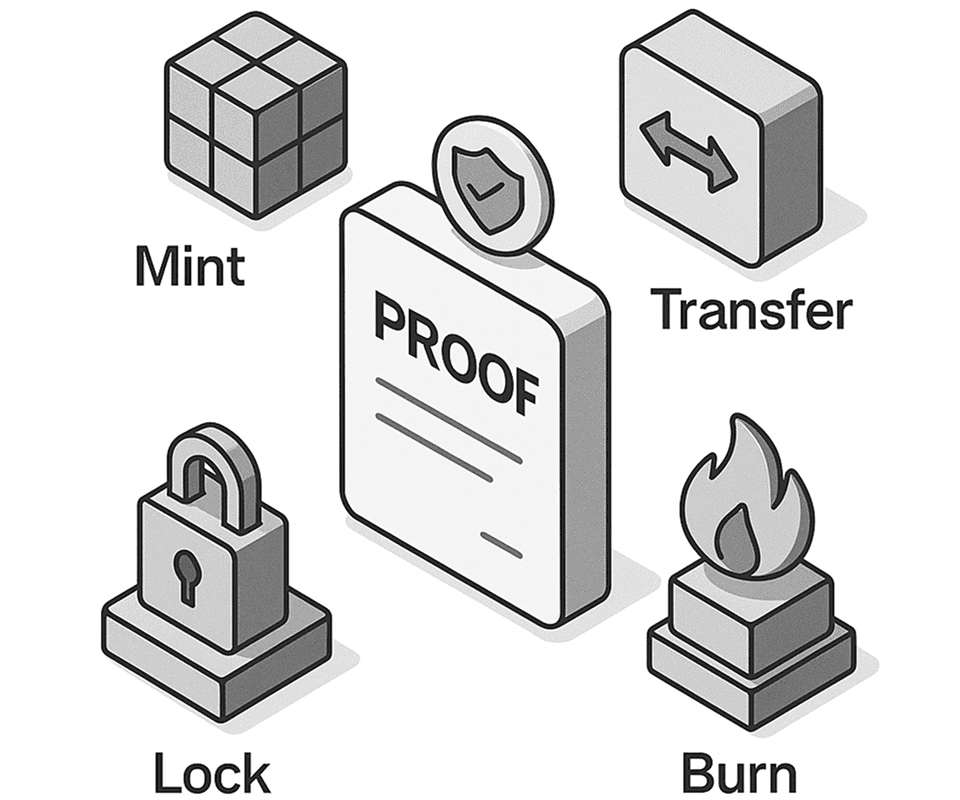

• Step 2: NuOrbit generates a cryptographically signed Settlement Proof.

• Step 3: Counterparties accept this proof as final settlement. You keep the custody. We provide the certainty.

What You Get

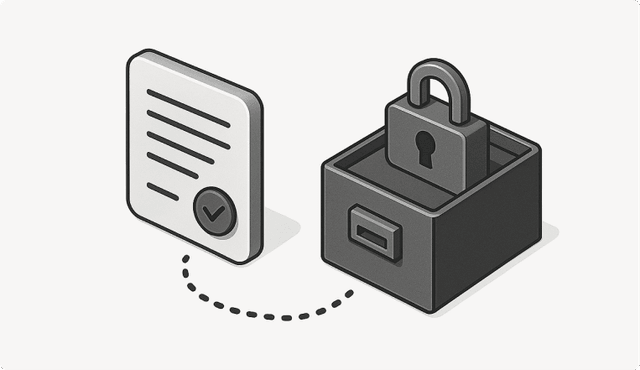

Clear Asset Location

Never wonder "where" the asset is. It's in your vault. What moves is the proof, not the token.

Audit-Ready Records

Stop taking screenshots of block explorers. NuOrbit provides structured, signed records for every transaction, ready for your auditors and regulators.

Operational Leverage

Compress settlement cycles from T+2 days to T+2 seconds. No opaque bridges. No counterparty risk. Just instant verification.

Institutional Grade Plays.

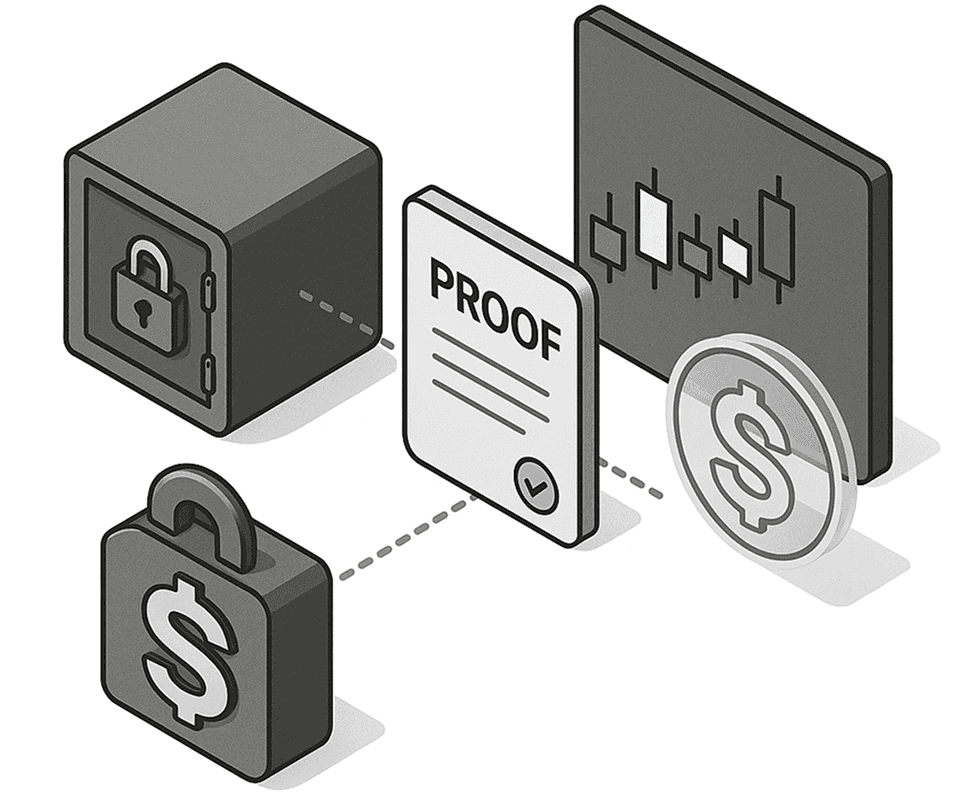

Asset Under Custody, Position in External Markets

Pledge assets as collateral for an external trade without moving them out of your segregated account. NuOrbit proves the lock; the exchange gives you the limit.

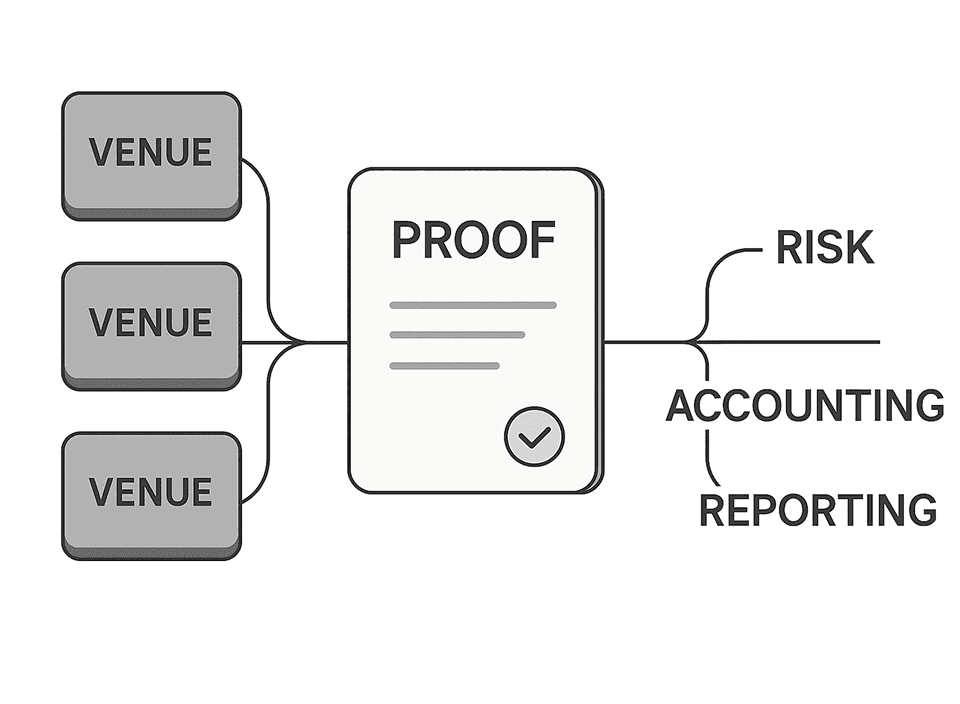

One Settlement Trail Across Many Venues

Feed NuOrbit proofs directly into your risk and accounting software. One canonical trail for all your digital asset activity.

Institutional Stablecoins and Tokenized Products

Issuing a regulated stablecoin? Use NuOrbit to prove mint/burn events to supervisors in a language they understand.

Define the Standard, or Follow It.

Regulators are cracking down on "black box" bridges. They demand provable settlement. The firms that adopt a Proof-Based Framework today will define what "Good Compliance" looks like for the next decade. Don't wait for the mandate. Build the rail that regulators will love.